social security tax rate 2021

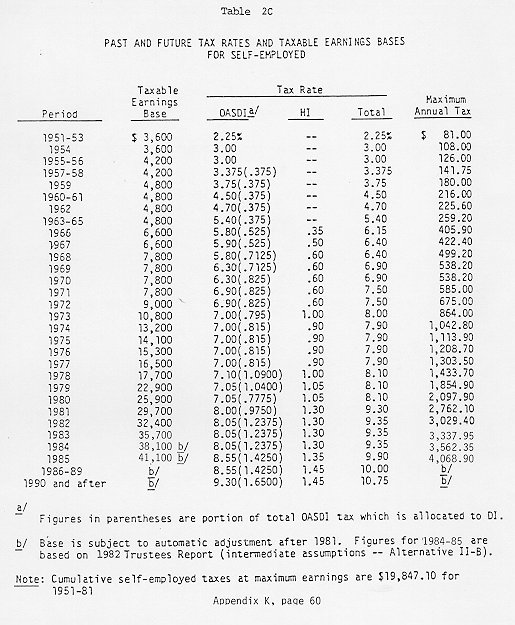

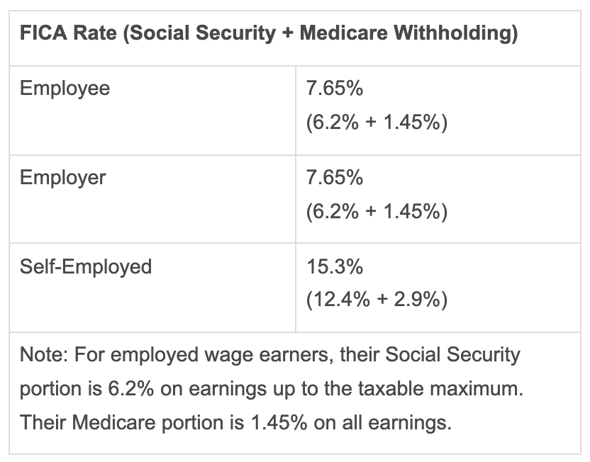

124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. Maximum earnings subject to Social Security taxes 2021 in dollars Program Amount.

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

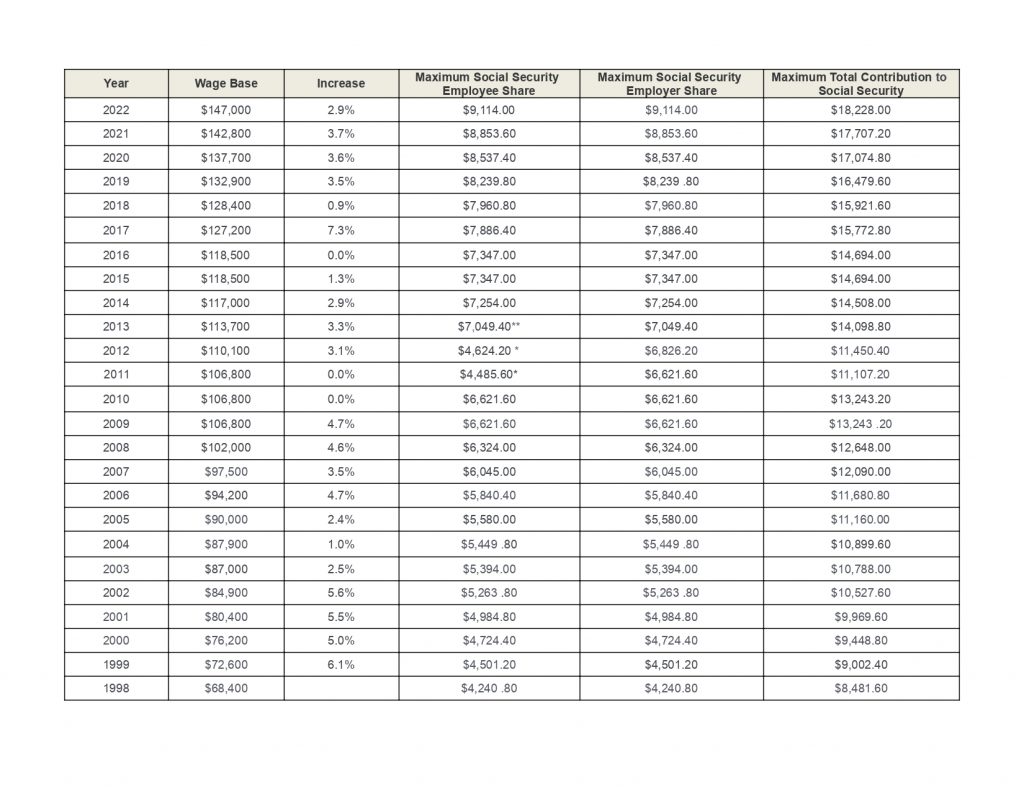

The largest increases were in 2020 and 2021 when the limit increased by 36 and.

. Generally up to 50 of benefits will be taxable. Anyone who earns under 142800 in 2021 has an effective Social Security tax rate of 62. Security which means they are not subject to Social Security taxes nor do they count toward a persons future Social Security benefits.

As a result the Trustees project that the ratio of 27 workers paying. Thus the most an individual employee can pay this year is 9114 Most workers pay their. In 2020 employees were required to pay a 62 Social Security tax on income of up to 137700.

As of 2021 that amount increased to 65 percent and in 2022 the benefits. Between 32000 and 44000 you may have to pay income tax on up to 50 percent of your benefits. Beginning in tax year 2020 the state exempted 35 percent of benefits for qualifying taxpayers.

However up to 85 of benefits can be taxable if either of the following situations applies. Retired at age 65. Under the change that deduction will be unlimited effectively.

If you have a combined income but are filing as an individual your benefits arent taxed if your benefits are below 25000. Currently taxpayers can deduct up to 24000 of social security income from their Colorado taxable income. Paying taxes as a household employer requires you to fill out and file Schedule H along with your federal income tax return and pay the tax amount due by April 18 2023.

Hence the maximum amount of the employers Social Security tax for each employee in 2021 is 885360 62 X 142800. All wages and self-employment income up to the Social Security wage base are subject to the 124 Social Security tax. If your income is above that but is below 34000 up to half of.

People also ask What is the standard deduction for. The rate consists of two parts. It shows the total amount of benefits you received.

More than 44000 up to 85 percent of your benefits may be taxable. Any earnings above that. WEP 1st Applied in 2021.

Someone who earns 1 million per year by contrast pays a much smaller percentage. Claimed Social Security at age 65 Retired at age 65. The social security tax has been in place since the 1930s and has been increased several times over the years.

However if youre married and file separately youll likely have to pay taxes on your Social Security income. Dear Customer An SSA-1099 is a tax form the SSA mails each year in January to people who receive Social Security benefits. Delayed Social Security claim until age 70 IRA withdrawals.

Maximum Taxable Earnings Rose To 142800. On earnings up to the appropriate taxable maximum amount the Social Security share OASDI is 620 percent see below. The most recent increase was in 1990 when the tax rate was.

The total of one-half of the benefits and. The federal government increased the Social Security tax limit in 10 out of the past 11 years. Social Security taxes in 2022 are 62 percent of gross wages up to 147000.

Employers Social Security Payroll Tax for 2022 The employers. Presenting the Budget for 2022 to Parliament in 2021 former Finance Minister Basil Rajapaksa removed the Nation Building Tax and introduced the Social Security Tax. IRS Tax Tip 2021-66 May 12 2021 Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits.

The self-employment tax rate is 153. The wage base is adjusted periodically to keep pace. The 2022 limit for joint filers is 32000.

Social Security Wage Base 2021 And Updated For 2022 Uzio Inc

Social Security Tax Phaseout To Affect 300k Nebraskans

Usag Daegu Military Members Effective For The September Mid Month Pay Dfas Will Temporarily Defer The Withholding Of Your 6 2 Social Security Tax If Your Monthly Rate Of Basic Pay Is

Billionaires Finished Paying Social Security Taxes For 2021 Los Angeles Times

Hike Of Social Security S Taxable Wage Base Gets Renewed Attention Don T Mess With Taxes

2021 2022 Tax Brackets And Federal Income Tax Rates Bankrate

Taxes Payroll Taxes Especially Social Security Are Regressive Not The Homa Files

2021 Wage Base Rises For Social Security Payroll Taxes

Inflation Spikes Social Security Checks For 2022 Baker Holtz

The Social Insurance System In The Us Policies To Protect Workers And Families

Social Security Administration Announces 2022 Payroll Tax Increase Eri Economic Research Institute

81 Years Of Social Security S Maximum Taxable Earnings In 1 Chart The Motley Fool

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Historical Social Security And Fica Tax Rates For A Family Of Four Tax Policy Center

What Is The 2016 Maximum Social Security Tax The Motley Fool

Federal Income Tax Brackets For 2022 What Is My Tax Bracket

United States Social Security Rate 2022 Data 2023 Forecast 1981 2021 Historical